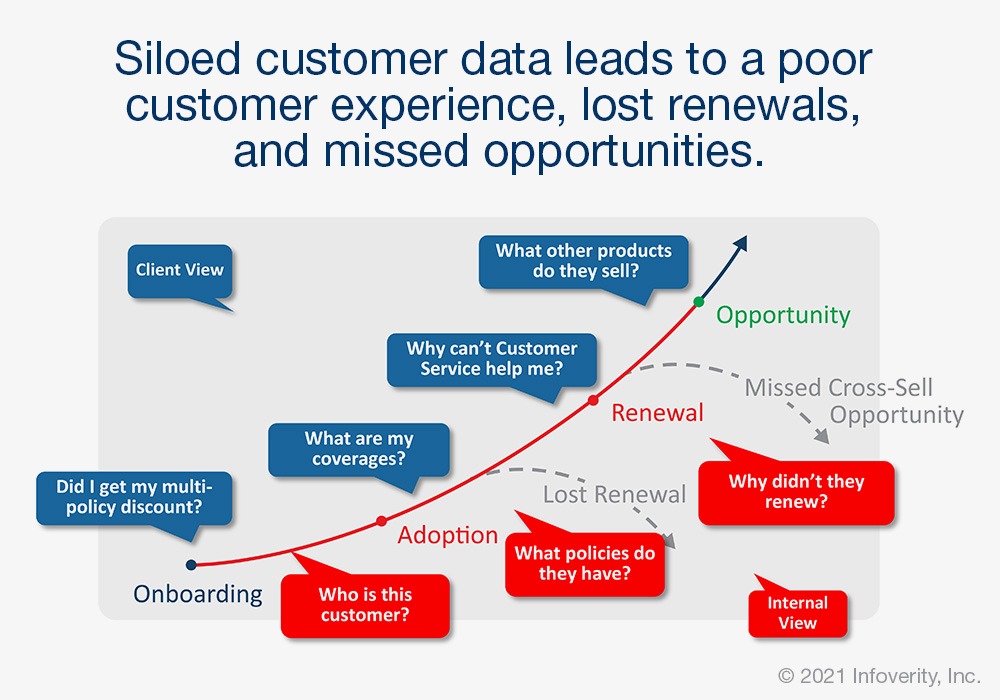

To grow and retain policyholder’s and expand their user base, insurance companies need to improve underlying infrastructure, as well as change processes, internal culture, and ensure trusted data is leveraged to support their initiatives. The global pandemic accelerated a push for insurance companies to improve customer experience across all channels and provide a holistic, more personalized content experience. However, many insurance companies struggle to improve CX because, hobbled by siloed data, they are managing policies, not customers and are unable to stitch together customer and policy data.

Four Steps to Connecting Customer and Policy Data

- Customer Data | Understand your short and long term view of customer data before jumping into a customer Master Data Management (MDM) implementation. This could be as simple as performing data profiling or as extensive as a full customer data strategy and roadmap across all lines of business to understand where and how customer data is authored, edited and stored throughout the company.

- MDM Maturity Model | It’s also important for your company to determine where it stands on the maturity model for customer data. Where are you now? Where do you want to be? Develop a tactical and strategic roadmap that starts with a MDM foundation to relieve the worst pain points and build toward longer term initiatives.

- Prioritize Benefits | Prioritize the biggest benefit in the shortest period of time. Identify customer data pain points and critical use cases, interview key stakeholders and identify the biggest problem areas and the cost of the pain points.

- Address Standardization | Start small by implementing a tool to perform address standardization and validation. Addresses are key components of customer data and can provide immediate benefits.

One of the main reasons for failure of customer data initiatives is the business sponsors don’t realize benefits fast enough. Therefore, it’s important to create a plan to build the foundation of where you want to be in two to three years.

This MDM foundation should allow you to relieve critical pain points in three to five months. Start with the most important customer source systems, such as PAS, CRM and ERP. These systems will allow you to stitch policies to policyholder/customer data. Continue to build your foundation by identifying the critical customer data elements, connecting policy and customer data across systems to create a unified view of a customer, which will allow you to identify policyholder and household relationships. Finally, send the data to a consuming analytical/reporting platform for marketing purposes. Start simple with batch processing and work toward real time. Again, the key here is to get the foundation built quickly.

Once the Customer MDM foundation is built, start planning the next phases to determine which use cases will provide the biggest business benefit. Consider:

- Bringing in additional LOBs or additional systems

- Integration back to the source systems to improve customer service and providing a shared view of a customer across LOBs and systems

- Performing real time integration to provide policyholders, customer service, Marketing and Underwriting immediate customer information

- Linking additional domains (I.e. Product, Location) to get a full picture of the customer, where they’re located and their products

Interested in learning more best proven insurance strategies? Check out “How Trusted Data Enables Policyholder Growth & Retention”

About Infoverity

For more information on Infoverity solutions, contact us today.